If you decide to register for a course in Australia with a duration of six months or exceeding it, your status would be regarded as that of an Australian resident for taxation purposes. This would mean that you'll need to fulfill tax obligations on your earnings in Australia at the prevailing rate applicable to Australian residents. Moreover, you might also gain access to advantages provided by the Australian tax framework. These advantages might encompass a tax-free threshold (contingent on how long you remain during the financial year), tax offsets, and potentially more favorable tax rates compared to individuals classified as foreign residents.

For Australian students who need to file tax returns, there are specific requirements based on their residency status and sources of income, including international earnings. However, the rules differ for international students on temporary visas in Australia.

For temporary residents, most of their income earned abroad generally isn't subject to Australian taxation. Consequently, it isn't necessary to include this foreign income in their Australian tax return. Their reporting obligation mainly covers income generated within Australia and any income earned from work or services performed overseas while residing in Australia as a temporary resident.

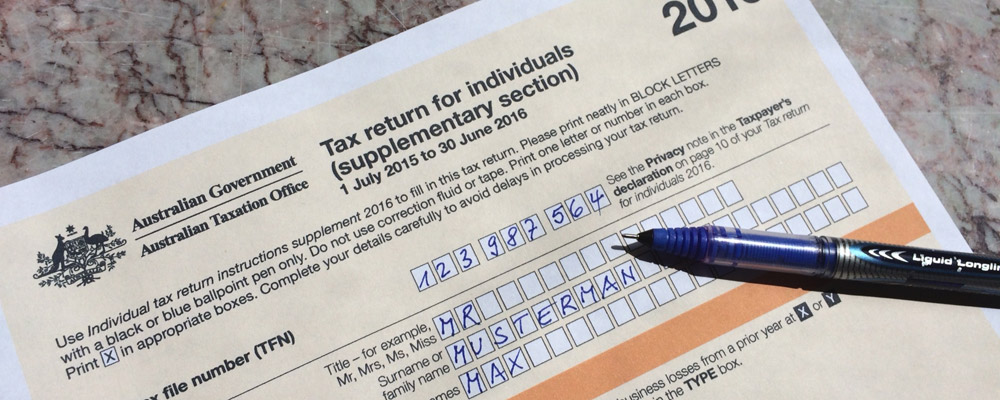

When engaging in the tax return procedure in Australia, it's essential to account for all income streams and eligible deductions. The Australian Taxation Office (ATO) will then assess whether the individual qualifies for a tax refund or owes additional taxes. Given the ongoing impact of the COVID-19 pandemic, one's income might have been influenced, or they might be eligible for specific deductions.

Our affiliated entity, Bricks Accountants, boasts a team of proficient tax professionals led by a certified Registered Tax Agent. We take pride in delivering a service that has garnered an 'Excellent' rating from past clients, along with a commitment to a swift and seamless process. Our seasoned agent meticulously scrutinizes all income and expense documentation before submitting the tax return to the ATO. This meticulous approach guarantees a hassle-free experience for you.